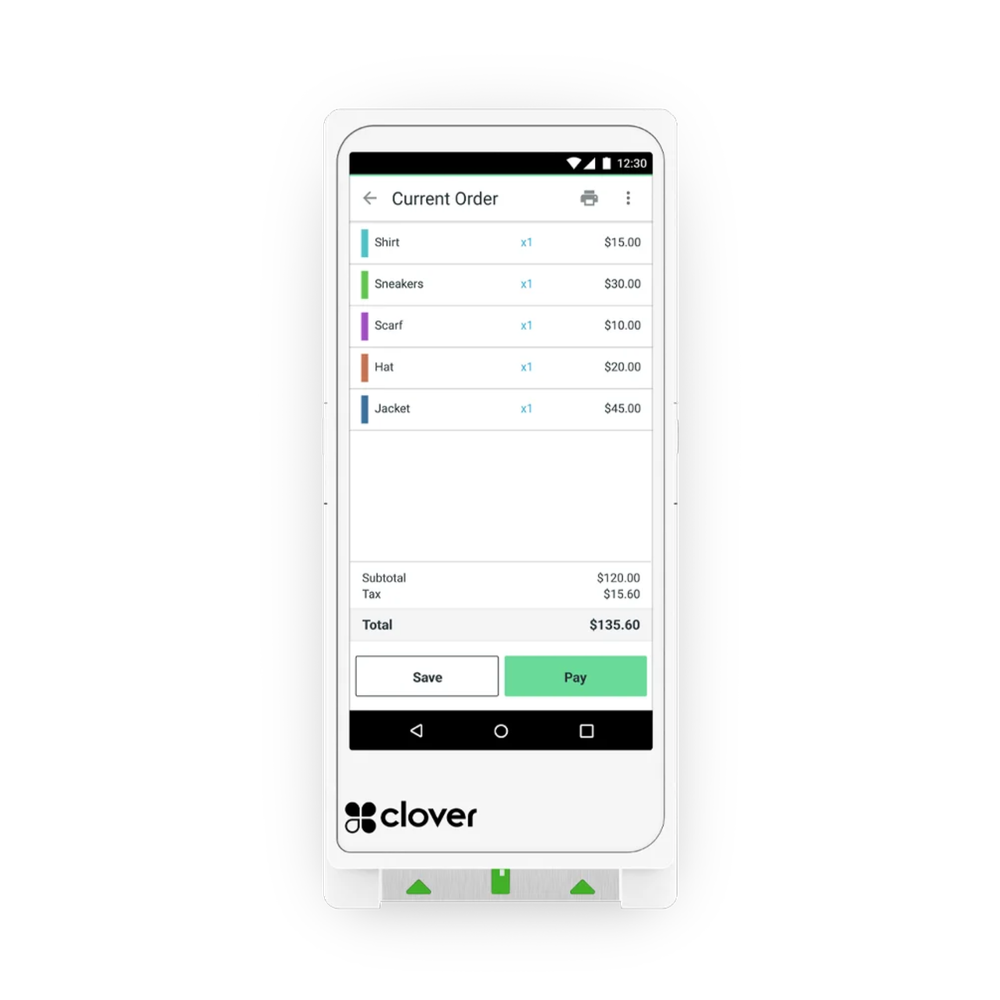

Clover Flex:

the handheld POS system

Run your business wherever you go

- Tap & Pay

- Dip & Pay

- Contactless payments

- Debit Tap

Speed.

Power.

Flex‑ibility.

Accept All Payment Types

Take payments on the go

Handheld POS system

More than a traditional credit card machine.

The Clover Go Card Reader does everything a traditional credit card machine can do and more,

with less headaches and at a fraction of the cost.

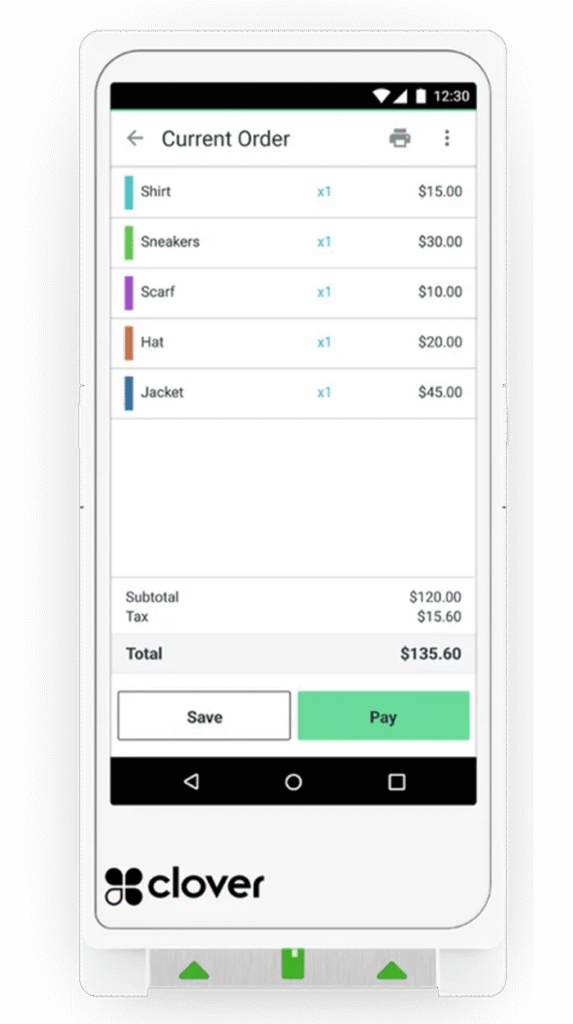

Card Reader

EMV Chip Card Reader, NFC Reader, and MSR Reader

Printer

Built-in Thermal Receipt Printer

Wireless Communication

4G LTE | WIFI

Display

5.99-inch, 720×1440 XHDPI Display

the handheld POS system

Contactless Payment

Entry on Screen

Indicator

Power Button

Speaker

Warning: Undefined array key "hotspot_offset_x" in /home/swipayth/vynzopay.com/wp-content/plugins/elementor-pro/modules/hotspot/widgets/hotspot.php on line 1059

Warning: Trying to access array offset on value of type null in /home/swipayth/vynzopay.com/wp-content/plugins/elementor-pro/modules/hotspot/widgets/hotspot.php on line 1059

USB-C Charging Port

Warning: Undefined array key "hotspot_offset_x" in /home/swipayth/vynzopay.com/wp-content/plugins/elementor-pro/modules/hotspot/widgets/hotspot.php on line 1059

Warning: Trying to access array offset on value of type null in /home/swipayth/vynzopay.com/wp-content/plugins/elementor-pro/modules/hotspot/widgets/hotspot.php on line 1059

Barcoden Scanner / 5MP Camera

Warning: Undefined array key "hotspot_offset_x" in /home/swipayth/vynzopay.com/wp-content/plugins/elementor-pro/modules/hotspot/widgets/hotspot.php on line 1059

Warning: Trying to access array offset on value of type null in /home/swipayth/vynzopay.com/wp-content/plugins/elementor-pro/modules/hotspot/widgets/hotspot.php on line 1059

Receipt Printer

Start accepting payments today.

Frequently asked questions

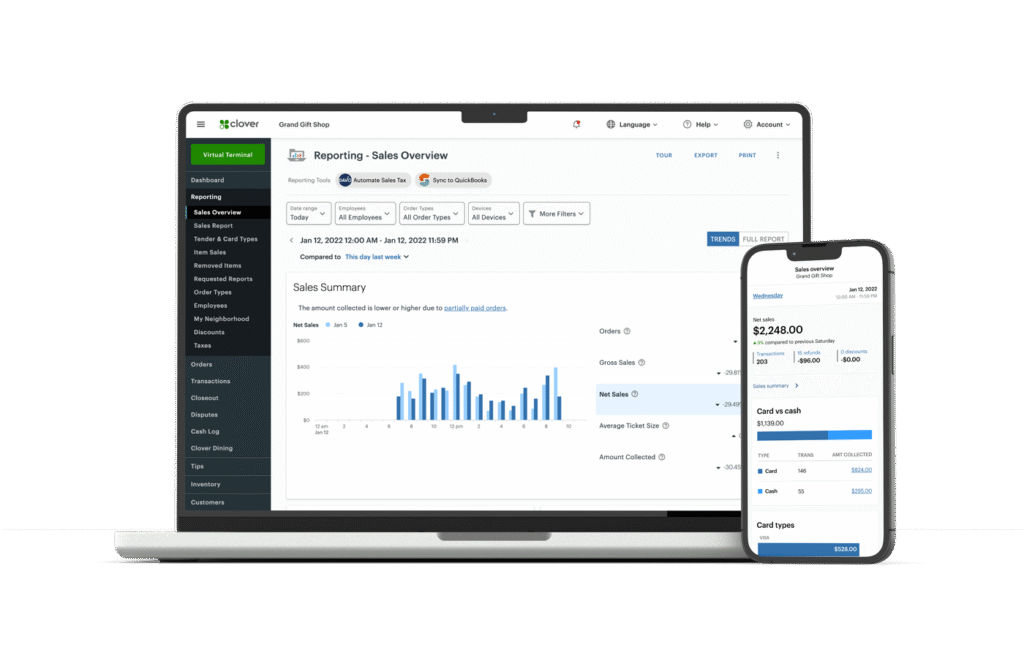

Fast funding you can count on.

Our network of processors offers next-day funding, depending on the time your transactions are settled.

Transactions processed on weekends or bank holidays are initiated for deposit on the next business day.

Each day, your transactions are batched and deposited to your bank account—net of processing fees—so you get paid quickly and efficiently.

No monthly fees. No hidden charges. Just real support for small business success.

Keep accepting payments online and in-person with great low rates, full access to our merchant tools, and industry-leading support—without paying a single monthly

After your documents and DocuSign signatures are complete, we submit your account and hardware order together.

Shipping typically takes 2–3 business days, but may take up to 5 days in the U.S. and 7 in Canada.

Transparent. Fair. Cost-saving.

With Interchange Plus pricing, you see the true cost of every transaction—plus one low markup. No hidden fees, no surprises.

Learn more on our [Pricing Page] and discover how this model can save you more than flat-rate pricing.

Use your existing bank account—no new account needed.

Sole proprietors may use a personal account, while incorporated businesses and partnerships must use a business account.

Law firms and other specialized businesses can customize deposit and fee flows to meet their requirements.

Absolutely! Our pricing rewards your growth.

As your transaction volume increases, your Interchange Plus margin is reduced automatically—putting more money back in your business.

Check out the full discount tiers on our [Pricing Page]

Get started in minutes—no paperwork, no hassle.

Sign up right from your phone or computer in just 5 minutes. After you submit your business details, one of our account managers will personally assist you with the rest of the process.